Home » Posts tagged 'Barclays'

Tag Archives: Barclays

An inquiry will only benefit us and the banks if done properly

July 2, 2012 5:25 pm / Leave a Comment

We have a law on fraud, and Ed Balls is right to bring attention to s.2 and s.4 of the Fraud Act (2006). Contrary to what George Osborne and Lord Tunnicliffe said either innocently, negligently or fraudulently, this law is to be found in the statute book. It’s hard to get away from the fact that interest rate rigging is a criminal offence; in the same way that phone hacking in the ways described by News Corporation has been found to be a criminal offence. This complete denial of what is a criminal offence by the Conservatives, further by disingenuously implying that there is insufficient regulation generally, is highly disturbing. Whilst there is no law yet for the LIBOR fixing in the financial services legislation itself, the Special Fraud Office is more than capable in ascertaining whether there is sufficient evidence to prosecute for fraud by abuse of position or by false representation, theft by false accounting, or, more likely, a conspiracy to defraud. A law specifically on LIBOR was proposed by Labour earlier this year, and the Coalition rejected it. This open discussion about whether our law is inadequate, from all parties, has only served to undermine trust in our law; the common contention is that you can go to prison for years if you shoplift a bottle of mineral water in the riots, but a trillion dollar fraud will go unpunished.

All parties can go through the motions of whether the system was sufficiently regulated, but we have a fraud criminal justice system in this UK. More importantly, the US have a foreign corrupt practices Act, which may have extra-territorial effect here. So it is somewhat distracting that Mark Hoban in 2006 apparently said that it was necessary to send out a firm message that Britain had a ‘light regulation’ régime. The Tories are scared of the City, and are totally disinterested in a coherent full analysis of the corporate culture which leads to immoral and criminal activity.

The issue anyway with having a full Leveson-style inquiry that this might have sent out a message that there was something wrong with the investment banking industry of the City, and such a spectacle might have been followed around the world from corporate investors with great scrutiny. Donations from the financial sector have risen steeply since David Cameron became leader of the Conservative party. A study by the Bureau for Investigative Journalism has found that the City accounted for £11.4m of Tory funding – 50.79% of its total haul – in 2010, a general election year. This compared with £2.7m, or 25% of its funding, in 2005, when David Cameron became party leader.

In her interview with Andrew Neil yesterday, Rachel Reeves MP, Shadow Chief Secretary to the Treasury, repeated an apology from Labour that ‘mistakes had been made’ regarding regulation. However, nobody can deny that Labour had tried extremely hard to woo the City during the Blair/Brown years. Prof. Anthony Giddens, previously at Cambridge and now at the London School of Economics, puts a brave gloss on this approach by New Labour:

“Most of Labour’s policy prescriptions followed from this analysis. The era of Keynesian demand management, linked to state direction of economic enterprise, was over. A different relationship of government to business had to be established, recognising the key role of enterprise in wealth creation and the limits of state power. No country, however large and powerful, could control that marketplace: hence the “prawn cocktail offensive” that Labour launched to woo the support of the City.”

There have been numerous inquiries in recent history, including the Saville Inquiry, the Chilcot inquiry and the Leveson Inquiry. It is far from certain whether these inquiries lead to enforceable end-points, let alone interesting and relevant law, and possibly are implemented to play for time and allow a political buffering space. This may, or may not be, the actual reason why David Cameron has this afternoon pledged a full parliamentary inquiry, rather a judicial inquiry, into the rate-fixing scandal banking industry. According to the PM, evidence will be obtained on full oath, and begin very soon, in the form of a parliamentary inquiry. This parliamentary inquiry into banking to be chaired by Treasury select committee chairman Andrew Tyrie – support form Treasury officials. The Government will establish a joint Committee from the Commons and the Lords. The terms and references should build on the Select Committee work, and also current trends in international regulaten. Oath of current MPs and House of Lords. The Joint Committee will report by the end of this year. This will mean in practical terms that the Banking Reform Bill will be redrafted next year.

However, Ed Miliband has voiced his concerns that such an inquiry will not command the trust and confidence of the public:

“It’s right he reconsidered the need for a full inquiry. I am not convinced by his way forward as I do not believe it measures up to the scale of the task. …People are understandably angry about how the banks let them down. There had already been a number of Select Committee reports into the banking inquiries….. We will continue to campaign for a full, open and independent enquiry to built trust with the bankers.”

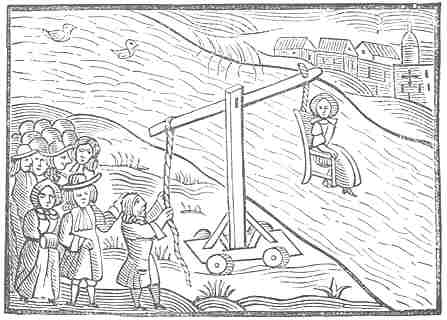

In support of Ed’s argument, whilst banks and newspapers exist in the private sector, their actions are pervasive the fabric of society. However, trial-by-media is perhaps not the correct punishment for the LIBOR-fixing scandal. As for phone hacking, criminal sanctions are. Ed Miliband would presumably have preferred a judicial-inquiry, as the modern day equivalent of the mediaeval ducking school, in justice being seen to do. This also produces short-term political capital, but it is ironically it is this short-termism which has been the fundamental problem with the Wall Street approach to banking.

George Osborne intends to make amendments to the Financial Services Bill, so that any financial penalties accrued in future will go to the public. Osborne has therefore asked Martin Wheatley to review what changes are required to the mechanism of setting of LIBOR, the activity of regulators, recommendations concerning the transparency of the process, and scrutiny of the adequacy of current civil and criminal powers with special reference to market abuse and LIBOR. Wheatley is going to report this summer, so that the regulatory authorities can implement the requisite action. This is an extremely effective response. Osborne proposes that a long and costly judicial inquiry is not necessary, and this notion is indeed supported to the guidance to implementation of the Inquiries Act (2005) (download here). Rather, the Banking Reform Bill will bring lasting changes to the operations of banks, including-ringfencing, and clarity on the civil and criminal sanctions. However, George Osborne claims that this will address the culture which has gone wrong with the banking industry.

Osborne is wrong about the state of the fraud law which has been enacted, on advice of a Law Commission. That is incredibly deceitful. More worryingly, he has no grasp on how toxic cultures come about in corporate organisations. Wrong employees are recruited, employees act illegally in a drive to improve shareholder dividend, employees are too scared to whistleblow about the toxic culture, and there is mutual collusion with other parties in a systemic pathology, including for example accountants and auditors. A mature, expert-led review is the only way to address this, if done properly, and examine the issues in meticulous detail which are clearly different from ‘Bloody Sunday’, phone hacking or going into war against Iraq.

The psychopathy of the corporate personality; lessons for law from cognitive neurology

June 29, 2012 5:45 am / Leave a Comment

In cognitive neurology, ‘psychopathy’ does not mean ‘a tendency to kill someone’ as is common thought by the general public. ‘Psychopathy’ is literally a ‘suffering of the mind’, and is used by cognitive neurologists to refer to individuals who cannot understand the mental states of others. This inability to understand the mental state of another in your mind is thought to go to awry in autism, from the seminal work by Prof Uta Frith, at UCL (and who was awarded an Honorary Doctorate at Cambridge this year) and Prof Simon Baron-Cohen, Macurdy Professor of Abnormal Psychology at Cambridge. It is even thought an ability to monitor to your own mental state, in particular distinguish internally-generated mental states from those of other people, can lead to conditions such as schizophrenia, causing delusions.

Salomon v Salomon provides the pivotal House of Lords case in English law, establishing that the body corporate has a separate legal personality. The concept of a corporate having a personality allows it to commit crimes such as manslaughter and fraud. It is fitting that there should now be a term called ‘corporate psychopathy’ to describe the sickness of the organisational cultures of otherwise ‘successful’ corporates. Had Lord Denning been alive today, he would have been the first to ask his juniors to consider how best to pierce the corporate veil to bring relevant parties to justice. ENRON, News International and Barclays provides three horrific examples of the emergence of ‘corporate psychopathy’, where a company can be highly successful shareholder dividend generator, but is in fact morally and legally sick.

The shocking aspect about ENRON was that it was winning industry-level awards and highly profitable while being completely sick. In fewer than two decades, ENRON grew from nowhere to be America’s seventh largest company, employing 21,000 staff in more than 40 countries, however the firm’s success proved to have involved a giant scam. ENRON lied about its profits and stands accused of a range of shady dealings, including concealing debts so they didn’t show up in the company’s accounts. Kenneth Lay was ENRON’s former chief executive and chairman since 1986 refused to testify at the last moment after saying he had been pre-judged. That ENRON’s false accounting was not spotted sooner has prompted the accounting industry to take a hard look at itself. Strikingly, ENRON had like a malignant cancer had metasised to parts of the establishment. ENRON provided millions of dollars to finance Mr Bush’s 2000 election campaign. Mr Bush was a personal friend of Mr Lay, but has been quick to distance himself from any involvement with the firm.

News Corp provides another chilling example. A reporter and a private investigator who worked for the Murdoch-owned News of the World tabloid were convicted of phone-hacking in 2007. News International, Murdoch’s British newspaper arm, had said the hacking was limited to a single rogue reporter but more victims of hacking were revealed in 2009, suggesting the practice was widespread. On 15 July 2011, Brooks resigned as chief executive of News International, following widespread criticism of her role in the controversy. On 17 July 2011, she was arrested on suspicion of conspiring to intercept communications and on suspicion of corruption – making corrupt payments to public officials. On 13 March 2012, she was again arrested on suspicion of conspiracy to pervert the course of justice. On 15 May 2012, Brooks was charged with conspiracy to pervert the court of justice. Murdoch apologized in person to Milly Dowler’s family and his company took out full-page advertisements in British newspapers saying, “We are sorry.” Andy Coulson, who followed Brooks as editor of the News of the World, resigned after the 2007 convictions and was later appointed by then opposition leader David Cameron, Prime Minister, as his communications chief in 2007. Coulson was arrested on July 8 on suspicion of phone-hacking and corruption, and released on bail. Again, the comparisons are chilling. According to the Leveson Inquiry, Rebekah Brooks sent an effusive text message to David Cameron on the eve of his 2009 party conference speech, telling him: “Professionally, we’re definitely in this together”.

Bob Diamond is an Amercian banker, currently Group Chief Executive of British bank, Barclays Plc. He is also Chief Executive of Corporate & Investment Banking and Wealth Management, comprising Barclays Capital, Barclays Corporate and Barclays Bank. In early 2011, Barclays announced that Diamond would receive an annual bonus of £6.5 million in 2011, the largest of any CEO of a British bank. However, Diamond voluntarily gave up his bonus for 2012 after Barclays was fined £59.5 million by the FSA (£290m in total) “over the bank’s ‘serious, widespread’ breaches of City rules relating to the LIBOR and EURIBOR rates. The bank had been found to have lied, sometimes to make a profit, and other times to make the bank look more secure during the financial crisis. The UK’s Financial Services Authority (FSA), which levied a fine of £59.5 million ($92.7 million), gave Barclays the biggest fine it had ever imposed in its history. The FSA’s director of enforcement described such behaviour as “completely unacceptable”, adding “Libor is an incredibly important benchmark reference rate, and it is relied on for many, many hundreds of thousands of contracts all over the world.” Osborne has long been highly critical of City regulators for not spotting the accounting tricks used by Lehman Brothers to artificially inflate its balance sheet.

That there is something pathological in the corporate personality in the past of Barclays, what I have called “corporate psychopathy” has been vociferously criticised by Sir Mervyn King, the current Governor of the Bank of England: “That goes to both the culture in the banking industry and to the structure of the banking industry, from excessive levels of compensation, shoddy treatment of customers, to deceitful manipulation of one of the most important interest rates and now this morning to news of yet another mis-selling scandal.We can see we need a real change in the culture of the industry. And that will require two things – leadership of an unusually high order and changes to the structure of the industry.”

Mr Diamond gave the Today programme lecture in November 2011, saying that banks had to be “better citizens” and create a trustworthy culture.” (listen to this clip from the ‘Today’ programme on the BBC website); he proudly reported that, “the evidence of culture is how people behave when nobody is looking”. This is particularly horrific given the latest scandal news. What is worrying about ‘corporate psychopathy’ is that it seems to be supported by the mutual collusion of other corporates, who are often themselves healthy. For examples experts have claimed that under US law such transactions involved in the Lehman Brother affair could not be booked as sales. However, it is reported that crucially, City law firm Linklaters gave a legal opinion in 2006 that transactions booked under Repo 105 could be treated as sales under UK law. This appears to have enabled Lehmans to keep billions of dollars of debt off its US balance sheet.

There are some lessons to be learnt from cognitive neurology, most probably. One is that a psychopathic individual who has a complete inability to infer the mental states of others is incredibly hard to rehabilitate. Secondly, psychopathic individuals can function very well in other domains, some having extremely high IQs in fact. This is what makes it difficult in ascertaining the precise punishment for true ‘psychopathy’ as it is fundamentally a mental health issue. Instinctively, I feel that this makes it inherently difficult to know what precisely to do with a psychopathic corporate. Sure, you can dream up new methods of diagnosis and potential actions, as the US legislators did with their problem in the form of the Sarbanes-Oxley Act, but it is easily arguable that you are not treating the underlying cause.